In 2008, Spotify (created in Sweden) was launched in the European market, while its implementation in other countries took place throughout 2009.

As of April 2020, the company had 286 million monthly active users, including 130 million paying subscribers (source).

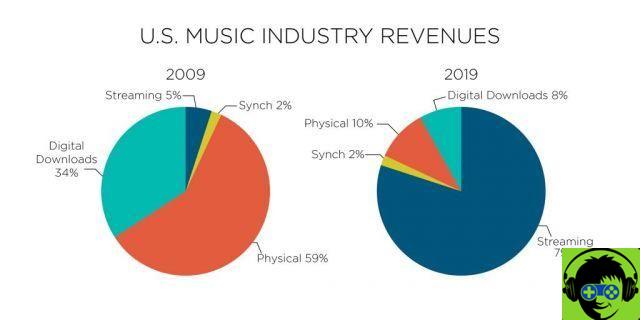

With its launch, a paradigm shift began in the way music is consumed, which eventually became a tsunami that swept away the notion of "owning" music.

Progressively, all the big tech companies (Google (2011), Amazon (2007), Apple (2015) -Microsoft had 2015-2018, but now offers Spotify), etc.) have launched their own music subscription service, trying to get a piece of the pie in recurring revenue.

Although year after year the pie has grown, so much so that everyone has seen their user base grow without the need to "steal" customers from competitors, it seems that this expansion may reach its limit, so the fun may be in the process of. Start…

The recorded music market

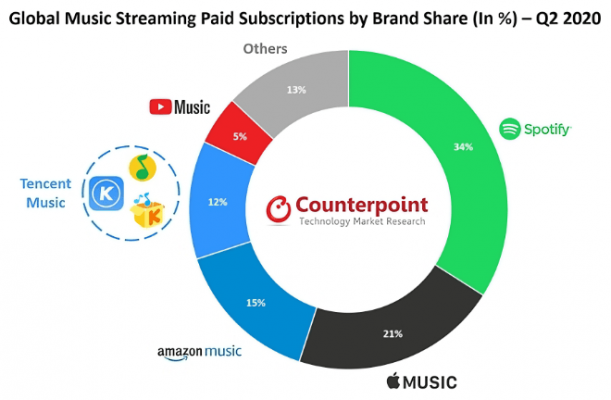

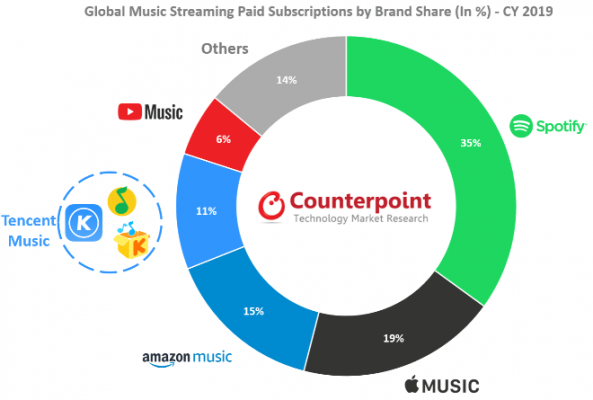

If we look at the market shares of recorded music consumption in Q2020 XNUMX, prepared by Counterpoint, we can see that it is starting to get really crowded.

Revenues from internet music broadcasting in the second quarter of 2020 decreased by 2% compared to the previous quarter, but still grew by 13% compared to the previous year.

This is the first time that revenues have fallen from the previous quarter, although there have been special conditions.

Paid subscriptions exceeded 400 million, up 29% over the previous year and 2% over the previous quarter. Growth in the previous quarter was 35% over the previous year and 7% over the previous quarter.

Counterpoint's study includes the top 15 streaming platforms taking into account their monthly active users (MAU), subscriptions, revenue and average revenue per user (ARPU).

Apple Music was the last to reach the market, according to the Counterpoint study, in the second quarter of 2020, it already has a market share of 21% in the segment of paid subscriptions.

One of the researchers, Abhilash Kumar, says in the report, “Growth slowed in the second quarter and, for the first time, revenue fell proportionally. There are a couple of reasons for this: Music streaming platforms are offering discounts and lowered prices on paid subscriptions to build customer loyalty or to prevent them from upgrading to a free plan. Likewise, ad revenue has seen a decline as many companies cut budgets due to the COVID-19 pandemic. However, podcasts have kept the audience loyal ».

In terms of monthly active users, Tencent Music (with its subsidiaries QQ Music, Kuwo and Kugou) leads the chart for Q2020 26 with a 12% share, followed by Spotify and YouTube Music respectively with 10% and 34%. However, when it comes to paid subscriptions, Spotify is still the leader with a 21% share, followed by Apple Music (15%) and Amazon Music (XNUMX%).

In contrast, the streaming music industry does not appear to have been affected by COVID-19 during the first quarter. In fact, the number of hours of streaming listening increased as people spent more hours at home. With the start of the second quarter, the market saw a slowdown in growth, determined by the decline in both paid subscriptions and advertising sales.

Customers that matter

From our point of view, Spotify's leadership in active users thanks to its free ad-supported option is a false feeling. Not only are those free listeners costing you money (which you have to pay the record companies in royalties) but the advertising you put in isn't enough to make up for that expense - beyond irritating the listener.

The customers that matter are the ones who pay, and in this Apple has always been clear (in this and in everything) that it does not want to be the leader in users, but in profitability.

That's why Apple doesn't have a free option and if you want to listen to their selections or their library or their radio stations, you have to pay.

In just five years it has gone from 0 to 21% paid market share, and is already just 13 points behind Spotify, which has serious problems financing its expansion, which has now turned to podcasts as a form of growth.

The same service on all platforms

Despite what Apple, Amazon, Google, Spotify… say in their advertisements, music is pretty much the same on all platforms, because they don't create it. They just resell the art of others.

So it is very difficult to differentiate yourself from the competition. Apple has opted for radio stations, Spotify has discovered podcasts, Amazon has it in its Prime offering, and Google (which has Google Play and YouTube)… seems to be putting all the weight on the brand.

All platforms are trapped between the ground - which means having to pay for every minute they broadcast - and the ceiling of the lack of differentiation between some platforms and others.

Surely, after the Apple One, we will see an Apple All or similar, which includes a subscription to music and books, where - in the style of Kindle - you can read and listen to anything you want for a monthly fee that includes Apple TV +, Arcade, etc.

Comfort versus possession

Those of us who grew up in the pre-digital age are used to "owning" the music we are passionate about. Swipe your hand over a vinyl cover, read the lyrics, etc.

That experience was seriously deteriorated with the arrival of the CD, where everything was smaller and "cheaper," but it made up for with convenience. You still had the music you loved and best suited in less space.

Now, from the first minute, you have all the music of history (that is) at your disposal, and the platforms themselves propose music lists so that you do not have to investigate, discover, delve into.

Why are you going to listen to that song from a month ago if you already have a hundred others?

Let's not say it's bad. We also use ready-made lists, perfect for when you don't want to think.

But the new generations are focused on today, now. They generally lack an insight into history and an interest in knowing how they got here.

And that, even if they are rich to pay a subscription every month, makes them stay poor.